0001289636DEF 14Afalse00012896362023-01-012023-12-310001289636pfie:OviattMember2021-01-012021-12-31iso4217:USD0001289636pfie:TidballMember2021-01-012021-12-3100012896362021-01-012021-12-310001289636pfie:OviattMember2022-01-012022-12-310001289636pfie:TidballMember2022-01-012022-12-3100012896362022-01-012022-12-310001289636pfie:OviattMember2023-01-012023-12-310001289636pfie:TidballMember2023-01-012023-12-310001289636ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberpfie:OviattMember2023-01-012023-12-310001289636ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberpfie:OviattMember2022-01-012022-12-310001289636ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberpfie:OviattMember2021-01-012021-12-310001289636ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberpfie:TidballMember2023-01-012023-12-310001289636ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberpfie:TidballMember2022-01-012022-12-310001289636ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberpfie:TidballMember2021-01-012021-12-310001289636ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310001289636ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-012022-12-310001289636ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-012021-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberpfie:OviattMember2023-01-012023-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberpfie:OviattMember2022-01-012022-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberpfie:OviattMember2021-01-012021-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberpfie:TidballMember2023-01-012023-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberpfie:TidballMember2022-01-012022-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberpfie:TidballMember2021-01-012021-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001289636ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001289636ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberpfie:OviattMember2023-01-012023-12-310001289636ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberpfie:OviattMember2022-01-012022-12-310001289636ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberpfie:OviattMember2021-01-012021-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310001289636ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001289636ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310001289636ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberpfie:OviattMember2023-01-012023-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberpfie:OviattMember2022-01-012022-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberpfie:OviattMember2021-01-012021-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberpfie:TidballMember2023-01-012023-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberpfie:TidballMember2022-01-012022-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberpfie:TidballMember2021-01-012021-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001289636ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001289636ecd:PeoMemberpfie:OviattMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001289636ecd:PeoMemberpfie:OviattMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001289636ecd:PeoMemberpfie:OviattMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001289636ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001289636ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001289636ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001289636ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberpfie:OviattMember2023-01-012023-12-310001289636ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberpfie:OviattMember2022-01-012022-12-310001289636ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberpfie:OviattMember2021-01-012021-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310001289636ecd:PeoMemberpfie:TidballMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-310001289636ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001289636ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310001289636ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-31000128963612023-01-012023-12-31000128963622023-01-012023-12-31000128963632023-01-012023-12-31000128963642023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant □

Check the appropriate box:

□ Preliminary Proxy Statement

□ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

□ Definitive Additional Materials

□ Soliciting Material Pursuant to § 240.14a-12

PROFIRE ENERGY, INC.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required

□ Fee paid previously with preliminary materials.

□ Fee computed on table in exhibit required by Item 25(g) per Exchange Act Rules 14(a)-6(i)(1) and 0-11

PROFIRE ENERGY, INC.

321 South 1250 West, Suite 1

Lindon, Utah 84042

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of Profire Energy, Inc. (the “Company,” “our” or “we”) will be held virtually using the instructions below on June 12, 2024, at 9:00 a.m. Mountain Daylight Time (the “Annual Meeting”) for the following purposes:

1.To elect five directors to the Company’s board of directors to serve until the next annual meeting of stockholders or until their successors are elected and qualified;

2.To conduct an advisory (non-binding) vote approving executive compensation (“Say-on-Pay”);

3.To ratify the appointment of Sadler, Gibb & Associates, LLC, as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and

4.To transact any other business as may properly come before the meeting or at any adjournment thereof.

The Annual Meeting will be conducted completely online via the Internet. Stockholders may attend and participate in the meeting by visiting www.colonialstock.com/pfie2024 To access the virtual Annual Meeting, you will need to click on the Virtual Meeting Instructions under the proxy materials to register for the meeting and enter the control number found on your proxy card. We encourage you to access the meeting before the start time of 9:00 a.m., Mountain Daylight Time, on June 12, 2024.

These business items are described more fully in the proxy statement accompanying this notice. Only stockholders who owned our common stock at the close of business on April 15, 2024, can vote at this meeting or any adjournments that may take place. A list of stockholders eligible to vote at the meeting will be available for inspection at the meeting and for a period of ten days prior to the meeting during regular business hours at our Lindon, Utah offices located at 321 South 1250 West, Suite 1, Lindon, Utah 84042.

On or about April 27, 2024, we plan to mail to our stockholders a notice of Internet Availability of Proxy Materials instead of a paper copy of this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”). The notice contains instructions on how to access those documents via the Internet. The notice also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement, the 2023 Form 10-K and a form of proxy card or voting instruction card, as applicable. Stockholders who do not receive a notice of Internet Availability of Proxy Materials will receive a paper copy of the proxy materials by mail. We believe this process minimizes the costs of printing and distributing our proxy materials.

YOUR VOTE IS IMPORTANT. PLEASE VOTE VIA THE INTERNET, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU RECEIVED A PAPER PROXY CARD AND VOTING INSTRUCTIONS BY MAIL, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IT IS IMPORTANT THAT YOU VOTE VIA THE INTERNET OR BY RETURNING YOUR PROXY CARD PROMPTLY EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING REMOTELY.

By order of the Board of Directors,

April 25, 2024

/s/ Ryan W. Oviatt /s/ Cameron M. Tidball

Ryan W. Oviatt Cameron M. Tidball

Co-Chief Executive Officer Co-Chief Executive Officer

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE PROFIRE ENERGY, INC. ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 12, 2024:

The Notice of Annual Meeting, the Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2023 and the proxy card are available via the Internet at:

www.colonialstock.com/pfie2024

PROFIRE ENERGY, INC.

321 South 1250 West, Suite 1

Lindon, Utah 84042

PROXY STATEMENT

ABOUT THE ANNUAL MEETING

This Proxy Statement (the “Proxy Statement”) is being furnished to the stockholders of Profire Energy, Inc., a Nevada corporation (the “Company,” “our” or “we”), in connection with the solicitation of proxies by our board of directors (sometimes referred to as the “Board” or “Board of Directors”) for use at our annual meeting of stockholders (the “Annual Meeting”), to be held virtually, at 9:00 a.m. Mountain Daylight Time, on June 12, 2024, or at any adjournment thereof.

The purpose of the Annual Meeting is:

1.To elect five directors to the Company’s Board of Directors to serve until the next annual meeting of stockholders or until their successors are elected and qualified;

2.To conduct an advisory (non-binding) vote approving executive compensation (“Say-on-Pay”);

3.To ratify the appointment of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and

4.To transact any other business as may properly come before the meeting or at any adjournment thereof.

Our Board has fixed the close of business on April 15, 2024, as the record date for determining stockholders entitled to notice of, and to vote at, the meeting. Only stockholders of record at the close of business on the record date will be entitled to attend and vote at the meeting and any postponements or adjournments thereof. A list of stockholders eligible to vote at the meeting will be available for inspection at the meeting and for a period of ten days prior to the meeting during regular business hours at our Lindon, Utah offices located at 321 South 1250 West, Suite 1, Lindon, Utah 84042.

We are pleased to make these proxy materials available over the Internet, which we believe benefits our stockholders and reduces the expense of our Annual Meeting. A notice of the Internet availability of the meeting materials (“Notice”) will be mailed to stockholders on or about April 27, 2024. You will not receive a printed copy of the meeting materials. Instead, the Notice will instruct you as to how you may access and review all the information contained in the meeting materials. Should you request a printed copy of meeting materials, we will make paper copies of these proxy materials available free of charge. To request a copy, please send your request to the Company’s Secretary by mail at the

address listed above, by toll-free phone at 1-877-285-8605, or by email at annualmeeting@colonialstock.com.

The Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2023 are also available on the Company’s website at www.profireenergy.com. The Company’s website address provided above is not intended to function as a hyperlink, and the information on the Company’s website is not and should not be considered part of this Proxy Statement and is not incorporated by reference herein.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board recommends that you vote FOR Proposals 1, 2, and 3 presented in this Proxy Statement.

Table of Contents

| | | | | |

| |

Proxy Information | |

PROPOSAL ONE | |

Board Nominees for Election of Directors | |

| Family Relationships | |

| Involvement in Certain Legal Proceedings | |

| Related Party Transactions | |

| Director Independence | |

Board Committees | |

| Board Leadership Structure and Role in Risk Oversight | |

| Report of Audit Committee Regarding 2023 Audited Financial Statements | |

| Board Meetings and Attendance of Annual Meetings | |

| Communications with Directors | |

Compensation of Directors and Executive Officers | |

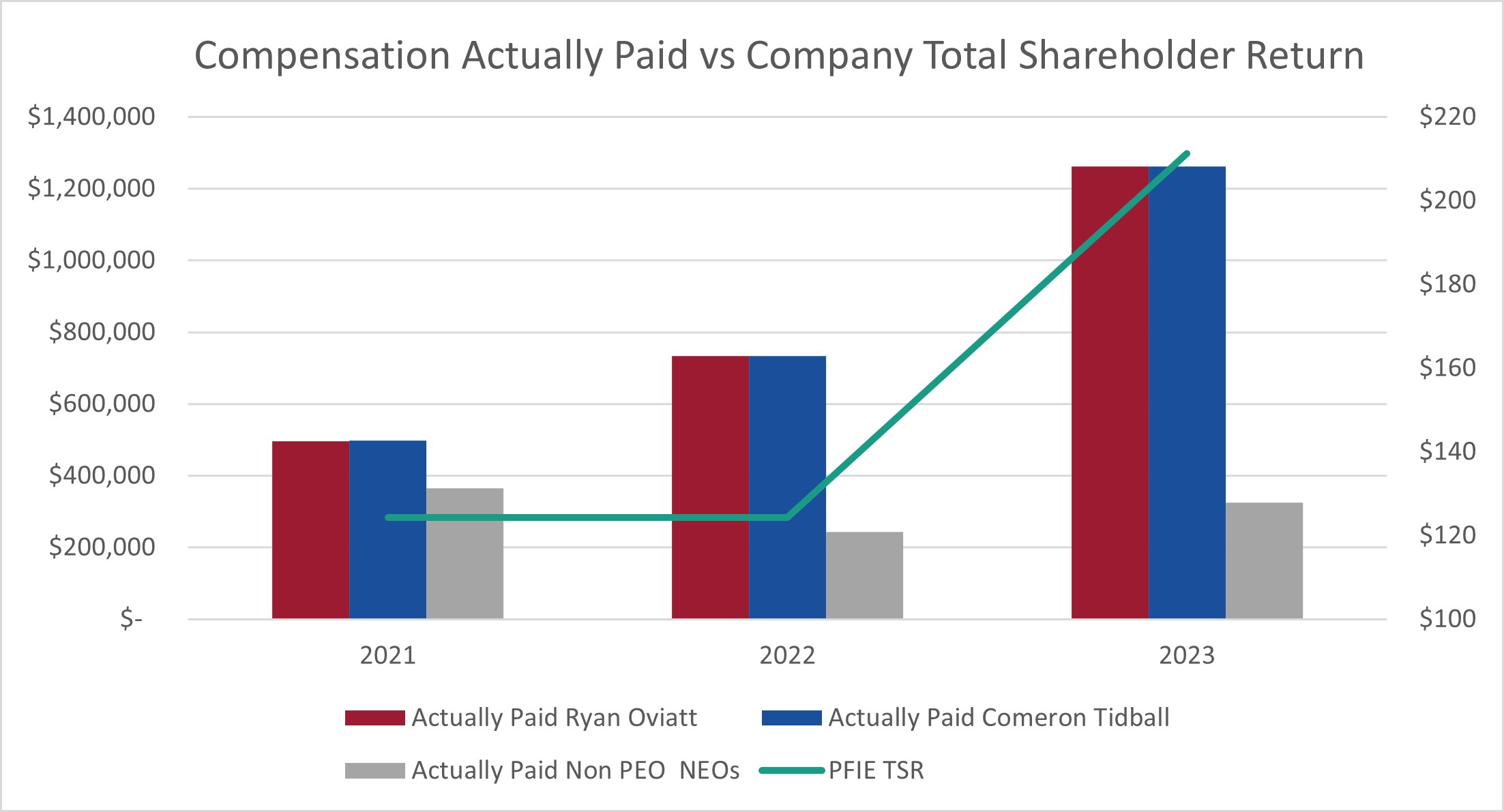

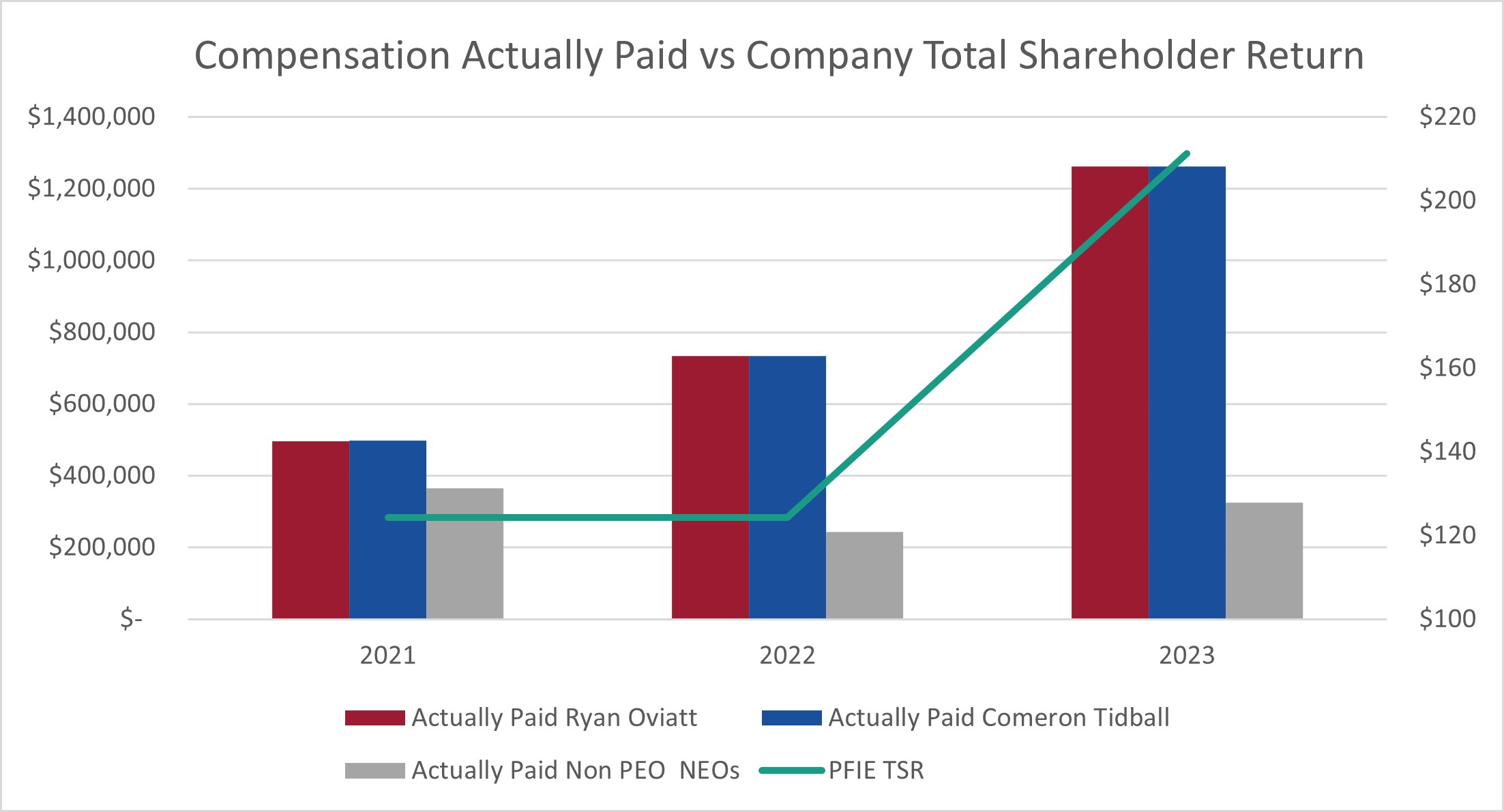

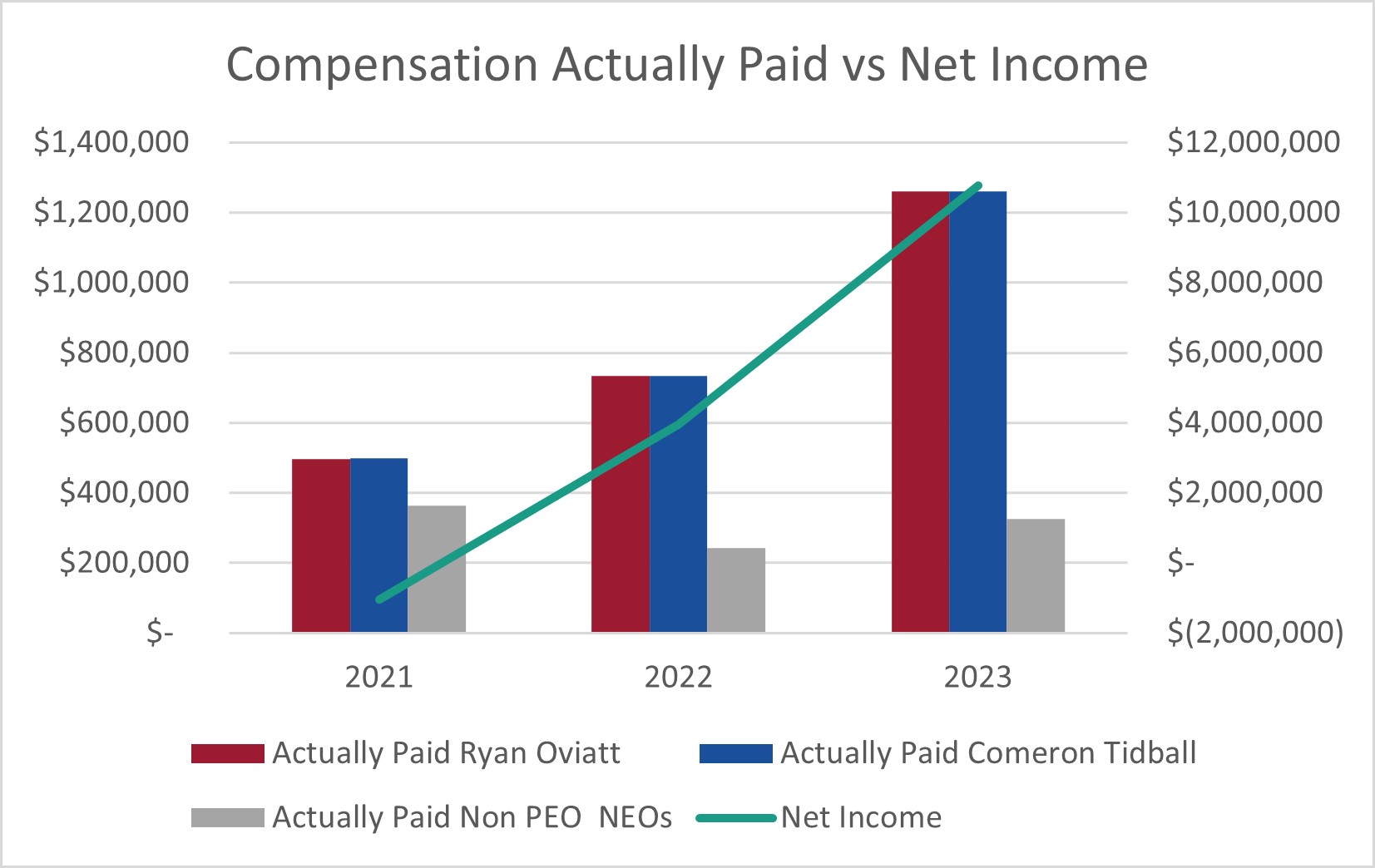

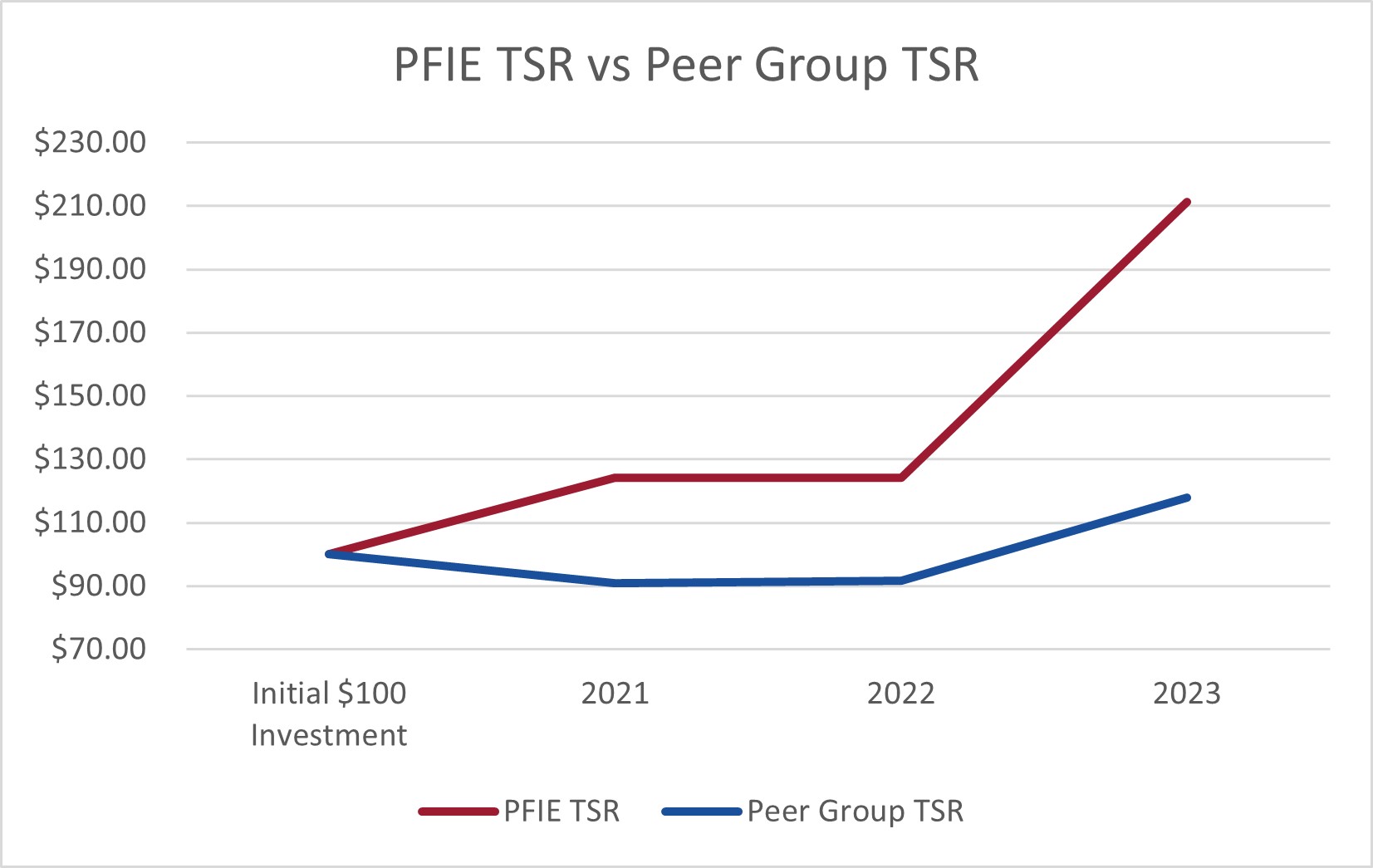

| Pay v Performance | |

| Security Ownership Of Certain Beneficial Owners, Nominees, Directors, and Executive Officers | |

PROPOSAL TWO- Say-on-Pay | |

PROPOSAL THREE- Ratification of Independent Auditor | |

Stockholder Proposals And Director Nominees For Next Annual Meeting | |

Appendix A Form of Proxy | |

PROXY INFORMATION

Who is soliciting my proxy?

The Board is soliciting your proxy to provide you with an opportunity to vote on all matters scheduled to come before the Annual Meeting, whether or not you attend the Annual Meeting.

Who is entitled to vote?

Only stockholders of record at the close of business on April 15, 2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournments. On the Record Date, there were 53,342,095 issued and 47,098,732 outstanding shares of common stock entitled to vote at the Annual Meeting. The shares of common stock are the only outstanding voting securities of the Company.

A list of stockholders entitled to vote at the meeting will be available for examination for ten days before the Annual Meeting at our corporate offices in Lindon, Utah.

When and where will the Annual Meeting be held?

The Annual Meeting will be held virtually on June 12, 2024, at 9:00 a.m., Mountain Daylight Time. The Annual Meeting will be conducted completely online via the internet. Stockholders may attend and participate in the meeting by visiting www.colonialstock.com/pfie2024. To access the virtual Annual Meeting, you will need to click on the Virtual Meeting Instructions under the proxy materials to register for the meeting. We encourage you to access the meeting before the start time of 9:00 a.m., Mountain Daylight Time, on June 12, 2024.

How do I vote my shares at the virtual meeting?

You can vote virtually during the Annual Meeting by use of a proxy card if you receive a printed copy of our proxy materials, or via internet or telephone as indicated on the proxy card. If you hold shares of our common stock as the stockholder of record, then you have the right to vote those shares at the Annual Meeting. If you are a beneficial owner and hold shares of our common stock in “street name,” then you can vote the shares you beneficially own through the online voting platform under a legal proxy from your bank, brokerage firm, or other nominee and are not required to take any additional action to obtain a legal proxy. Stockholders of record can follow the instructions at www.colonialstock.com/pfie2024 in order to vote their shares during the Annual Meeting. You will need the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. Even if you plan to attend the virtual Annual Meeting, you should submit a proxy card or voting instruction for your shares in advance so that your vote will be counted if you later decide not to attend the virtual Annual Meeting.

If you received printed proxy materials, you also have the option of submitting your proxy card by mail or attending the meeting and delivering the proxy card. The designated proxies will vote according to your instructions; however, if you are a registered stockholder of record and you return an executed proxy card without specific instructions on how to vote, the proxies will vote:

“FOR” the election of the nominated directors in Proposal 1;

“FOR” the advisory (non-binding) vote approving executive compensation (“Say-on-Pay”) in Proposal 2; and

“FOR” the ratification of the appointment of Sadler, Gibb & Associates, LLC, as the Company’s independent registered public accounting firm for the year ending December 31, 2024, in Proposal 3.

If your shares are held in the name of a bank, broker or other nominee, your shares are held in “street name.” If you are a “street name” stockholder and you do not return instructions on how to vote to your bank, broker, or other nominee, your shares will not be voted on Proposal 1 or Proposal 2. The voting of shares held by “street name” stockholders is further discussed below. Additionally, in order to vote at the meeting, you will need to obtain a signed proxy from the broker or nominee that holds your shares, because the broker or nominee is the legal, registered owner of the shares. If you have the broker’s proxy, you may vote by ballot or you may complete and deliver another proxy card in person at the meeting.

Why is the Annual Meeting a virtual, online meeting?

A virtual Annual Meeting allows us to conduct the Annual Meeting as scheduled and conduct the business before the meeting, with the possibility for full stockholder participation. We anticipate that a virtual meeting will provide greater accessibility for stockholders, encourage broader stockholder participation by those who would be unable to attend in person, and improve our ability to communicate more effectively with our stockholders during the meeting.

Why did I receive a notice of Internet Availability of Proxy Materials instead of a full set of the proxy materials?

SEC rules allow companies to furnish their proxy materials via the Internet. At the request of our stockholders we sent a notice of Internet Availability of Proxy Materials for the Annual Meeting, however, those stockholders that requested a physical copy of the proxy materials were sent a full set of materials. Both virtual and physical forms of proxy materials were sent to stockholders in a timely matter. Instructions on how to access the proxy materials via the Internet or to request a paper copy can be found in the Notice of Internet Availability of Proxy Materials.

Can I vote by completing and returning the notice of Internet Availability of Proxy Materials?

No, but the notice of Internet availability of proxy materials provides instructions on how to vote your shares.

How can I change my vote?

Registered stockholders can revoke their proxy at any time before it is voted at the Annual Meeting by either:

•Submitting another timely, later dated proxy;

•Delivering timely written notice of revocation to the Corporate Secretary, at 321 South 1250 West, Suite 1, Lindon, Utah 84042; or

•Attending the Annual Meeting and voting in person.

If your shares are held in the name of a bank, broker or other nominee, you must obtain a proxy, executed in your favor, from your bank, broker or nominee, which is the holder of record, to be able to change your vote at the Annual Meeting.

What are the quorum requirements for the Annual Meeting?

To hold an Annual Meeting and transact business, a majority of outstanding shares of common stock entitled to vote must be present in person at the Annual Meeting or represented by proxy.

Abstentions and broker non-votes (which occur when a broker indicates on a proxy card that it is not voting on a matter) are considered shares present at the Annual Meeting for the purpose of determining a quorum. Broker non-votes will not affect the outcome of the vote on any of the proposals to be voted upon at the Annual Meeting because the outcome of each vote depends on the number of votes cast rather than the number of shares entitled to vote, as further discussed below.

Abstentions and Broker Non-Votes

Stockholders may abstain from voting on any of the proposals. Abstentions are not counted as votes cast for a proposal. Additionally, abstentions will not be counted as votes for or against Proposals 1, 2, or 3.

A broker non-vote occurs when a broker submits a proxy vote with respect to shares of common stock held in a fiduciary capacity (typically referred to as being held in “street name”) but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in “street name,” brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include matters such as the ratification of auditors. Most other matters are considered non-routine matters, including the election of directors and advisory votes on executive compensation. Therefore, if you do not

give your broker or nominee specific instructions, your shares will not be voted on non-routine matters and may not be voted on routine matters. However, shares represented by such “broker non-votes” will be counted in determining whether there is a quorum present at the Annual Meeting for the purpose of transacting business. With regard to Proposals 1, 2, and 3, broker non-votes will not be counted for purposes of determining whether such proposals have been approved and will not have the effect of negative votes.

Who represents my proxy at the meeting?

If you do not vote in person at the Annual Meeting but have submitted your proxy by following the instructions on the Notice, you have authorized certain members of the Company’s management designated by the Board and named on your proxy card to represent you and to vote your shares as instructed.

How many votes am I entitled to cast?

You are entitled to cast one vote for each share of common stock you own on the Record Date.

How many votes are required to approve matters to be presented?

Proposal 1: Election of Directors. Directors in an Uncontested Election (as defined below) shall be elected if the number of votes cast for the nominee’s election exceeds the number of votes cast against the nominee’s election. In all director elections other than Uncontested Elections, the nominees for election as a director shall be elected by a plurality of the votes cast, provided a quorum is present in person or by proxy. A plurality means that the nominees receiving the most votes for election to a director position are elected as directors up to the maximum number of directors to be chosen at the meeting.

An “Uncontested Election” means any meeting of stockholders at which directors are to be elected and the number of nominees does not exceed the number of directors to be elected and with respect to which (i) no stockholder has submitted notice to nominate a candidate for election at such meeting in accordance with Paragraph 1.16 of the Company’s Bylaws, or (ii) such a notice has been submitted, and on or before the fifth business day prior to the date the Company files its definitive proxy statement relating to such meeting with the Securities and Exchange Commission (the “SEC”) (regardless of whether thereafter revised or supplemented), the notice has been (1) withdrawn in writing to the Secretary of the Company, (2) determined not to be valid notice of nominations, with such determination to be made by the Board of Directors (or a committee thereof), or if challenged in court, by a final court order, or (3) determined by the Board of Directors (or a committee thereof) not to create a bona fide election contest.

Proposal 2: Say-on-Pay.The proposal to approve, on an advisory basis, the Company’s executive compensation will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast in opposition of the proposal.

Proposal 3: Ratification of Auditors. The proposal to ratify the appointment of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2024, will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast in opposition of the proposal.

Will my shares be voted if I do not provide instructions to my broker?

If you are the beneficial owner of shares held in “street name” by a broker, the broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to the broker, the broker is only permitted to vote on items that are considered routine. Proposal 3 is the only routine matter being submitted to stockholders for approval at the Annual Meeting.

How will proxies be voted on other items or matters that properly come before the meeting?

If any other items or matters properly come before the meeting, the proxies received will be voted on those items or matters in accordance with the discretion of the proxy holders.

Is the Company aware of any other item of business that will be presented at the meeting?

The Board does not intend to present and does not have any reason to believe that others will present any item of business at the Annual Meeting other than those specifically set forth in the Notice of Annual Meeting of Stockholders. However, if other matters are properly brought before the Annual Meeting, the persons named on the enclosed proxy will have discretionary authority to vote all proxies in accordance with their best judgment.

Where do I find the voting results of the meeting?

We intend to report the voting results in a Current Report on Form 8-K, which we expect to file with the SEC within four business days after the Annual Meeting.

Who bears the costs of soliciting these proxies?

We will bear the cost of soliciting proxies. Certain directors, officers or employees may solicit proxies by telephone, facsimile, e-mail, and in person, without additional compensation. Upon request, we will also reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for distributing proxy materials to stockholders. All costs and expenses of any solicitation, including the cost of preparing this Proxy Statement and posting it on the Internet and mailing the proxy materials, will be borne by the Company.

Do I have dissenters’ rights for any matters being presented at the meeting?

No dissenters’ rights are available to any stockholder who dissents from any of the proposals set forth in the Proxy Statement under the Nevada Revised Statutes or under our current Articles of Incorporation or Bylaws.

PROPOSAL ONE

ELECTION OF DIRECTORS

Our Board of Directors currently has five members. The size of the Board will remain at five members following the Annual Meeting. Our Bylaws provide that the Board will consist of such number of directors to be fixed from time-to-time by resolution of the Board.

The Nominating and Governance Committee (the “Nominating Committee”) is charged with identifying potential Board members and recommending qualified individuals to the Board for its consideration. The Nominating Committee is authorized to employ third-party search firms to identify potential candidates. In evaluating candidates, the Nominating Committee considers, among other things:

•Education, background, skills, and experience that provide knowledge of business, financial, governmental, or legal matters relevant to our business or to our status as a public company;

•A high level of personal and professional ethics, integrity, and values;

•A reputation for exercising good business judgment;

•Commitment to representing the long-term interests of our stockholders;

•The fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial, and responsive to our needs; and

•Sufficient available time to fulfill the responsibilities of a member of the Board.

The Nominating Committee also considers whether individuals satisfy the independence criteria set forth in the NASDAQ listing standards, as well as any special criteria applicable to service on various standing committees of the Board. Our Board and the Nominating Committee believe it is desirable that Board members represent diversity of viewpoints, background, experience, and demographics, as well as diversity of gender, race, and national origin.

The Nominating Committee generally identifies nominees by first assessing whether the current members of the Board continue to provide the appropriate mix of knowledge, skills, judgment, experience, differing viewpoints and other qualities necessary to the Board's ability to oversee and guide the business and affairs of the organization. The Board generally nominates for re-election current members of the Board who are willing to continue in service, collectively satisfy the criteria listed above and are available to devote enough time and attention to the affairs of the organization. When the Nominating Committee seeks new candidates for director roles, it seeks individuals with qualifications that will complement the experience, skills and perspectives of the other members of the Board. The full Board (1) considers candidates that the Nominating Committee recommends; (2) considers the optimum size of the Board; (3) determines how to address any vacancies on the Board; and (4) determines the composition of all Board committees.

Board Diversity

| | | | | | | | | | | | | | |

Board Diversity Matrix (As of April 25, 2024) |

| Total Number of Directors | 5 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | |

| Directors | 1 | 4 | - | - |

| Part II: Demographic Background | |

| African American or Black | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | - | - | - |

| Hispanic or Latinx | - | - | - | - |

| White | 1 | 4 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

| Did Not Disclose Demographic Background | - |

Upon the recommendation of our Nominating Committee, the Board has identified and nominated five individuals to serve as directors for a one-year term expiring on the date of our next Annual Meeting, or until their successors are duly elected and qualified. Brenton W. Hatch, Colleen Larkin Bell, Ryan W. Oviatt, Daren J. Shaw, and Ronald R. Spoehel have been nominated by the Nominating Committee to stand for election as directors. Messrs. Hatch, Oviatt, Shaw and Spoehel and Ms. Bell currently serve as directors of the Company.

We intend that the proxies solicited by us will be voted for the election of the nominees named above. Each of the nominees has agreed to serve as a director if elected, and we believe each nominee will be available to serve. However, the proxy holders have discretionary authority to cast votes for the election of a substitute should any nominee not be available to serve as a director. The information represented in the table below is accurate as of the year ended December 31, 2023.

Board Nominees for Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Age | | Positions Held | | Director Since | | Officer Since |

| | | | | | | | |

Brenton W. Hatch | | 73 | | Chairman and Director | | November 2008 | | October 2008 |

Ryan W. Oviatt | | 50 | | Co-Chief Executive Officer, Co-President, and Chief Financial Officer and Director | | October 2018 | | September 2015 |

Colleen Larkin Bell | | 64 | | Director | | August 2020 | | N/A |

Daren J. Shaw | | 67 | | Director | | August 2013 | | N/A |

Ronald R. Spoehel | | 66 | | Director | | October 2013 | | N/A |

A brief description of the background and business experience of each nominee follows:

Brenton W. Hatch. Mr. Hatch has served as Chairman of the Board since November 2008. Mr. Hatch formerly served as Chief Executive Officer of the Company and was responsible for overseeing the day-to-day operations of the Company from October 2008 to July 2020. On July 2, 2020, Mr. Hatch transitioned from his prior role as Chief Executive Officer and President of the Company to service as Executive Chairman through June 30, 2021. At such time, Mr. Hatch transitioned to serve as a Special Advisor and Chairman through June 30, 2022. Mr. Hatch co-founded the Company’s wholly owned subsidiary, Profire Combustion, Inc., in 2002. Prior to founding Profire Combustion, between 2001 and 2002, Mr. Hatch was a Management Consultant and General Manager of Titan Technologies, Inc., an oilfield service and distribution company in Edmonton, Alberta, Canada. In this position, Mr. Hatch performed an in-depth analysis of the operations and management of all divisions of Titan Technologies. Based on his analysis, Mr. Hatch implemented company-wide operational changes to improve company performance. From 1989 to 2000, Mr. Hatch served as President and Chief Executive Officer of Keaton International, Inc., an educational services company based in Edmonton, Alberta, Canada. Mr. Hatch managed all executive functions of the company and particularly focused on the development and management of the company’s educational services. During his time at Keaton International, Mr. Hatch led corporate networking and marketing campaigns world-wide. Mr. Hatch earned a bachelor’s degree in education from the University of Alberta in 1974. We considered Mr. Hatch’s experience as a founder and his 20 years of experience as an executive officer of the Company and its wholly owned subsidiary along with his previous management and operational oversight experience in concluding that he should serve as a director of the Company.

Ryan W. Oviatt. Mr. Oviatt is the Co-Chief Executive Officer, Co-President, Chief Financial Officer, and Treasurer of the Company, with responsibility over all finance, accounting, operations, human resources, information technology, health, safety, and environment, quality control, and compliance functions of the Company. Mr. Oviatt has served as Co-Chief Executive Officer and Co-President of the Company since July 2020, as Chief Financial Officer of the Company since September 2015 and has served as a Director since October 2018. Previously, Mr. Oviatt was a Senior Manager at Rio Tinto, a publicly traded, international mining and metals company. During his time with Rio Tinto, he held significant responsibility for Sarbanes-Oxley compliance, financial reporting analysis, and other special projects from 2005 through 2015. He also managed value-tracking and reporting within the

company, leading to enhanced cash flow and reduced costs. Additionally, Mr. Oviatt served on technical committees relating to international tax, finance, and development of a significant international Rio Tinto mining operation. He also helped mentor and develop personnel and management. Prior to Rio Tinto, Mr. Oviatt was an Audit Manager at Ernst & Young, LLP from 2000 through 2005, where he audited both public and private clients, including oil and gas companies. Mr. Oviatt received his bachelor’s degree in accounting from Westminster College, and master’s degree in accountancy from Brigham Young University. He is a certified public accountant in Utah. We considered Mr. Oviatt’s extensive management experience at Profire as well as his experience and leadership in other senior financial roles at and related to public companies, in determining that he should serve as an officer and director of the Company.

Colleen Larkin Bell. Ms. Bell served as the president of MountainWest Pipeline Company, an interstate natural gas pipeline company that provides transportation and underground storage services in Utah, Wyoming, and Colorado until January 2023. Prior to this role she served as Vice President and General Manager of Dominion Energy Western Distribution, Gas Infrastructure Group. She was responsible for all company functions related to the delivery of natural gas to over 1,000,000 homes and businesses in the Utah, Wyoming and Idaho service territory. She carries an extensive background of over 30 years in both law and the natural gas and energy industries. Prior to the merger with Dominion Energy in 2016, she served as Vice President and General Counsel for Questar Corporation, holding primary responsibility over Questar Corporation’s legal and insurance departments. She reported directly to the company’s chief executive officer and was the chief legal advisor to Questar’s board of directors. Ms. Bell has received a myriad of prestigious awards and accolades over the course of her tenure and is active in a number of charitable and other organizations, including serving on the Utah Energy Infrastructure Authority Board of Directors, the board of YMCA, and Gorgoza Mutual Water Company board. She received her bachelor’s degree in English, with a minor in political science from the University of Utah and her law degree from the S.J. Quinney College of Law, University of Utah. We considered Ms. Bell’s extensive management experience, awarded legal expertise, and years of active management in the oil and gas industry in determining that she should serve as a director of the Company.

Daren J. Shaw. Mr. Shaw has served for more than 30 years in leadership capacities with several financial services firms. Mr. Shaw retired as Managing Director of Investment Banking at D.A. Davidson & Co., a middle-market full-service investment banking and brokerage firm in early 2019. During his term as Managing Director at D.A. Davidson & Co., Mr. Shaw served on the Senior Management Committee and board of directors and as the lead investment banker in a wide variety of transactions including public stock offerings, private placements, and mergers and acquisitions. Prior to joining D.A. Davidson & Co. in 1997, Mr. Shaw served for 12 years with Pacific Crest Securities in various roles, including Managing Director. Since 2012, Mr. Shaw has served as a member of the board of directors of The Ensign Group, Inc. (NASDAQ: ENSG), a provider of skilled nursing, assisted living, and rehabilitative care services with approximately 302 facilities located in 14 states. He currently serves as Chairman of The Ensign Group’s audit committee and also serves on The Ensign Group’s compensation and nominating/governance committees. We considered Mr. Shaw’s extensive experience and leadership in the financial services industry and on the boards of directors of public and private companies in determining that he should serve as a director of the Company.

Ronald R. Spoehel. Mr. Spoehel has over 40 years of board, executive management, investment banking, and private investment experience, from Fortune 500 to technology startups. From 2007 to 2009, he served as the Presidentially-appointed, Senate-confirmed Chief Financial Officer of the National Aeronautics and Space Administration (NASA). Mr. Spoehel presently serves as Managing Partner of Windrock Capital LLC. He also serves on other U.S. and international private company and advisory

boards and has held various board, financial and general management positions with globally operating public and private companies in the U.S., Canada, Latin America, and Europe. Previously, he was a partner in various investment companies and served ten years in investment banking at Bank of America and Lehman Brothers, primarily focused on energy and technology sectors. Mr. Spoehel is an honors graduate of the University of Pennsylvania, where he received his Bachelor of Science degree in economics and Master in Business Administration from the Wharton School, and his Master of Science degree in engineering from the Moore School of Electrical Engineering. We considered Mr. Spoehel's ten years of service as a director of Profire, as well as his extensive experience and leadership in the energy and technology sectors and on the boards of directors of public and private companies in determining that he should serve as a director of the Company.

Family Relationships

There are no family relations among any of our executive officers, directors or key employees.

Involvement in Certain Legal Proceedings

To our knowledge, none of our officers, directors or affiliates or any owner of record of 5% or more of our common stock, or any associate of any of the foregoing, is a party adverse to the Company or any of our subsidiaries or has a material interest adverse to the Company or any of our subsidiaries.

Related Party Transactions

Our Audit Committee Charter requires that the Audit Committee review, approve or oversee any transaction between the Company and any related person (as defined in Item 404 of Regulation S-K) and any other potential conflict of interest situations on an ongoing basis, and to develop policies and procedures for the Audit Committee’s approval of transactions with related persons.

During the year ended December 31, 2023, the Company did not engage in any related party transactions, and there are currently no proposed related party transactions.

Director Independence

The Board has determined that of the current directors or nominees, Ms. Bell, Mr. Shaw and Mr. Spoehel qualify as independent directors as that term is defined in the listing standards of the NASDAQ Stock Market. Such independence definition includes a series of objective tests, including that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. As Mr. Oviatt is employed by the Company, and Mr. Hatch was employed by the Company through June 30, 2022, the Board has determined that neither of them is currently independent.

Board Committees

Audit Committee. The Audit Committee of the Board is responsible for the selection, review and oversight of the Company’s independent registered public accounting firm; approval of all audit, review and attest services provided by the independent registered public accounting firm; and the integrity of our reporting practices and evaluation of internal controls and accounting procedures. The Audit Committee is responsible for the pre-approval of all non-audit services provided by its independent registered public accounting firm. Non-audit services are only provided by our independent registered public accounting firm to the extent permitted by law. Further, all related party transactions are reviewed and approved by the Audit Committee.

The Audit Committee is chaired by Daren J. Shaw and consists of Ms. Bell, Mr. Shaw, and Mr. Spoehel, all of whom qualify as independent directors. The Board believes that Mr. Shaw qualifies as an audit committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. The Board has adopted a written charter to govern the activities of the Audit Committee, which is available on our website at www.profireenergy.com. The Audit Committee held four meetings during the fiscal year ended December 31, 2023.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee (the “Nominating Committee”) of the Board is responsible for identifying and recommending director candidates for nomination by the Board. The Nominating Committee is chaired by Colleen Larkin Bell and consists of Ms. Bell, Mr. Shaw, and Mr. Spoehel, all of whom qualify as independent directors. In general, when the Board determines that expansion of the Board or replacement of a director is necessary or appropriate, the Nominating Committee will identify candidates through candidate interviews with members of management, consultation with the candidate’s associates and other means to determine qualifications to serve on our Board.

Each candidate to serve on the Board must possess the highest personal and professional ethics, integrity and values, and be committed to serving the long-term interests of our stockholders. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating Committee may consider such other factors as it may deem appropriate, which may include, without limitation, professional experience, diversity of backgrounds, skills and experience at policy-making levels in business, government, financial, and in other areas relevant to our global operations, experience and history with our company, and stock ownership.

We do not have a formal policy with regard to the consideration of diversity in identifying Board nominees, but the Nominating Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee our business.

The Nominating Committee will consider director candidates recommended by the Company’s stockholders pursuant to the procedures described in this Proxy Statement or validly made in accordance with applicable laws, rules and regulations and the provisions of our Bylaws. Stockholders wishing to recommend candidates should do so in writing to the Nominating Committee, c/o Corporate Secretary, Profire Energy, Inc., 321 South 1250 West, Suite 1, Lindon, UT 84042. Please refer to the section below entitled “Stockholder Proposals and Director Nominees for Next Annual Meeting” for further information. The Nominating Committee may also consider candidates proposed by current directors, management, employees and others. All such candidates who, after evaluation, are then recommended by

the Nominating Committee and approved by the Board will be included in our recommended slate of director nominees in our proxy statement.

To date, we have not paid any fee to any third-party to identify or evaluate, or to assist in identifying or evaluating, potential director candidates, but we may consider doing so in the future if the Nominating Committee determines that engaging a consultant is in the best interests of the Company. The Board has adopted a written charter to govern the activities of the Nominating Committee, which is available on our website at www.profireenergy.com. During the fiscal year ended December 31, 2023, the Nominating Committee held one meeting.

Compensation Committee. The Compensation Committee of the Board reviews and advises the Board on executive compensation. The Compensation Committee is chaired by Ronald R. Spoehel and consists of Ms. Bell, Mr. Shaw and Mr. Spoehel, all of whom qualify as independent directors.

The Compensation Committee oversees all aspects of our executive compensation program and incentive compensation. It reviews and advises the Board on the corporate goals and objectives applicable to the compensation of our Co-Chief Executive Officers, recommends to the full Board for approval compensation amounts for the Co-Chief Executive Officers and all other executive officers, reviews and makes recommendations to our Board relating to incentive compensation and equity-based plans, and reviews and makes recommendations to the full Board regarding employment agreements and severance agreements or plans for the Co-Chief Executive Officers and other executive officers.

In November 2022, the Compensation Committee engaged a third-party consultant, Compensation Advisory Partners ("CAP"), to support the Compensation Committee in its efforts to review and advise upon executive compensation. CAP was engaged to assist the Compensation Committee in the following main areas:

–Provide a collaborative review and approval of a compensation peer group and establish a group of companies that will be used to report market compensation levels and practices for both executive & director compensation;

–Review and advise on executive compensation, including base salary, bonus targets/opportunity, actual bonus payouts, long-term incentive award values, and total direct compensation;

–Complete a comprehensive review of director compensation levels and structure; and,

–As part of the review CAP was engaged to provide a summary of, among other things, peer company/market pay mix, board structure, details on number of meetings and paid and unpaid directors.

Pursuant to its charter, the Compensation Committee may delegate its authority to a subcommittee or subcommittees. The Board has adopted a written charter to govern the activities of the Compensation Committee, which is available on our website at www.profireenergy.com. The Compensation Committee held two meetings during the fiscal year ended December 31, 2023.

Board Leadership Structure and Role in Risk Oversight

Currently, Brenton Hatch, who served as our Executive Chairman until June 30, 2021 and then served as a Special Advisor to the Company’s executive officers until June 30, 2022, serves as Chairman

of our Board. We do not have an independent lead director. Given our current size, resources and access to potential qualified director candidates, the Board believes the most effective leadership structure for the Company at this time is to have Mr. Hatch continue to serve as Chairman. The Board believes that it should be able to select the Chairman of the Board based on the criteria that the Board deems to be in the best interests of the Company and its stockholders and that our current combined structure promotes unified leadership, a cohesive vision and strategy for the Company and clear and direct communication to the Board.

Board-level risk oversight is performed by our full Board. Our risk oversight process includes an ongoing dialogue between management and the Board, intended to identify and analyze risks that the Company faces. Through these discussions with management and their own business experience and knowledge, our directors are able to identify material risks for which full analysis and risk mitigation planning are necessary. The Board monitors risk mitigation action plans developed by management in order to ensure such plans are implemented and are effective in reducing the targeted risks.

Report of Audit Committee Regarding 2023 Audited Financial Statements

The Audit Committee has reviewed and discussed with management and the independent registered public accounting firm (i) the consolidated financial statements as of December 31, 2023, and (ii) management’s assessment of the effectiveness of the Company’s internal controls over financial reporting as of December 31, 2023. Management has represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

The Audit Committee has received the written disclosures and letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting firm's communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the independent registered public accounting firm's independence.

Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements referred to above be included in our Annual Report on Form 10-K for the year ended December 31, 2023.

Daren J. Shaw

Colleen Larkin Bell

Ronald R. Spoehel

Board Meetings and Attendance at Annual Meetings

The Board held six meetings during our fiscal year ended December 31, 2023. In 2023, each director attended all of the meetings of the Board held during the period and the total number of meetings held by all committees of the Board on which they served, except Ms. Bell was unable to attend the Board, Audit Committee, and Compensation Committee Meetings held on March 6, 2023.

Although it is not mandatory for directors to attend annual meetings of stockholders, each director is encouraged to attend meetings of stockholders. The Company held its last annual meeting of stockholders on June 15, 2023, and five out of the five directors then serving were in attendance.

Communications with Directors

Stockholders and other parties interested in communicating with the Board may do so by writing to the Chairman of the Board of Directors, Profire Energy, Inc., 321 South 1250 West, Suite 1, Lindon, Utah 84042. The Chairman of the Board will review and forward to the appropriate members of the Board copies of all such correspondence that, in the opinion of the Chairman, deals with the functions of the Board or that he otherwise determines requires their attention.

Employee, Officer and Director Hedging

The Company has adopted a policy regarding insider trading both to satisfy the Company’s obligation to prevent insider trading and to help Company personnel avoid the severe consequences associated with violations of insider trading laws. The Company considers it improper and inappropriate for any director, officer, or other employee of the Company to engage in short-term or speculative transactions in the Company’s securities. It therefore is the Company’s policy that directors, officers and other employees may not engage in short sales, publicly traded options, margins accounts and pledges, and hedging transactions. An exception to the prohibition of pledges exists where a person wishes to pledge Company securities as collateral for a loan (not including margin debt) and clearly demonstrates the financial capacity to repay the loan without resorting to the pledged securities.

Compensation of Directors and Executive Officers

The following table sets forth information regarding our named executive officers or “NEOs” for 2023. Please refer to the section above entitled “Board Nominees for Election of Directors” for Mr. Oviatt’s biographical information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Age | | Positions Held | | Director Since | | Named Executive Officer Since |

| | | | | | | | |

| Ryan W. Oviatt | | 50 | | Co-CEO, Co-President, CFO, Director | | October 2018 | | September 2015 |

| Cameron M. Tidball | | 47 | | Co-CEO, Co-President | | N/A | | March 2018 |

| Patrick D. Fisher | | 46 | | VP of Product Development | | N/A | | April 2019 |

Cameron M. Tidball. Mr. Tidball commenced serving as the Company’s Co-Chief Executive Officer and Co-President of the Company in July 2020. Mr. Tidball is responsible for the strategic direction and day-to-day operations of the Company’s sales and marketing efforts, service delivery, development of products and technologies, and business development initiatives related to market expansion. Mr. Tidball previously served as the Company’s Chief Business Development Officer from March 2018 to July 2020 and was responsible for all sales and marketing initiatives, business and product development, and service delivery. Mr. Tidball joined the Company in 2010 as a Regional Sales Manager and in 2012 he became the Vice President of Sales and Marketing. Prior to joining the Company, Cameron worked for Direct Energy, a retail provider of natural gas, electricity and renewable energy, from 2008 through 2010, where he held a Senior Management position managing customer care operations for the provinces of Alberta and British Columbia. Before his time at Direct Energy, he was employed from 2003 through 2008 at TELUS, a global communications technology company, where he managed customer experience strategies and initiatives for a network of global call centers. Mr. Tidball earned a Bachelor of Commerce degree in Marketing & Management Science from the University of Alberta. He also received a technical diploma in Engineering Design from the Northern Alberta Institute of Technology.

Patrick Fisher. Mr. Fisher commenced serving as the Company’s Vice President of Product Development in April of 2019 and is responsible for overseeing the Company’s direction and product development focus. Mr. Fisher joined the Company in 2009 and began working on product research and development. He oversees many aspects of new product development and existing product maintenance, from determining the customer’s needs, through development and production ramp-up to launching the product into the market and long-term support. Mr. Fisher started at the Company as the sole member of the R&D team and worked with one external contractor to develop the PF2100 BMS, our flagship product for the past decade. Mr. Fisher enjoyed the opportunity to build the R&D team from the ground up. He has continued to lead the Company’s R&D efforts building out all subsequent iterations of the BMS product line. Prior to working at the Company, Mr. Fisher worked as a product developer at Eleven Engineering. He gained experience in electronics hardware development and learned much about engineering culture and collaboration during his time there. He was involved in various aspects of the development cycle, including a stint in China ramping up production. Mr. Fisher studied Engineering at Red Deer College and completed his education at NAIT in Electronics Engineering Technology.

Executive Compensation Highlights: Principles and Objectives

Our executive compensation program is designed to:

•Link pay to performance;

•Attract and retain talented executive officers and key employees;

•Emphasize performance-based compensation to motivate executives and key employees;

•Reward individual performance; and

•Encourage long-term commitment to the Company and align the interests of executives with stockholders.

We meet these objectives through the appropriate mix of compensation, including:

•Annual base salary;

•Short-term incentives that include both cash bonuses and equity awards; and

•Long-term incentives, consisting of equity awards tied to performance and restricted stock units (“RSUs”).

The following table summarizes the total compensation paid to our NEOs.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($)(1) | Stock Awards ($) | Nonequity incentive plan compensation ($)(4) | All Other Compensation ($) | Total ($) |

| Ryan Oviatt | 2023 | $341,550 | $800 | $370,029(2) | $ 148,021 | $ - | $860,400 |

| Co-CEO, Co-President, CFO | 2022 | $328,846 | $12,500 | $372,933(3) | $ 174,933 | $ - | $889,212 |

| | | | | | | |

| Cameron Tidball | 2023 | $341,550 | $800 | $370,029(2) | $ 148,021 | $ - | $860,400 |

| Co-CEO, Co-President | 2022 | $328,846 | $12,500 | $372,933(3) | $ 174,933 | $ - | $889,212 |

| | | | | | | |

Patrick Fisher(5) | 2023 | $141,864 | $593 | $75,978(2) | $ 27,145 | $ - | $245,579 |

| VP of Product Development | 2022 | $141,619 | $9,599 | $79,536(3) | $ 43,929 | $ - | $274,682 |

1.In December 2022 each employee received a Christmas bonus in the amount of $500 before taxes in their local currency. In September 2022 the Company provided a bonus to each employee due to the Company receiving a tax credit related to the Employee Retention Credit in the United States. Each employee received a bonus based on seniority and each of Messrs. Oviatt and Tidball received a $12,000 US bonus and Mr. Fisher received a $12,000 CAD bonus. In December 2023 each employee received a Christmas bonus in the amount of $800 in their local currency.

2.In accordance with the SEC executive compensation disclosure rules, the amounts shown in 2023 for stock awards represent the grant date fair value of such awards determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“FASB ASC Topic 718”). The amounts included in the Stock Awards column for the PSUs granted during 2023 are calculated based on the probable satisfaction of the performance conditions for such awards as of the date of grant. Assuming the highest level of performance is achieved for the 2023 PSUs, the maximum value of such PSUs at the grant date would be as follows: Mr. Oviatt—$433,769; Mr. Tidball—$433,769; Mr. Fisher—$91,752; See Note 11 to Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 for a discussion of the relevant assumptions used in calculating the amounts reported for 2023.

3.In accordance with the SEC executive compensation disclosure rules, the amounts shown in 2022 for stock awards represent the grant date fair value of such awards determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“FASB ASC Topic 718”). The amounts included in the Stock Awards column for the PSUs granted during 2022 are calculated based on the probable satisfaction of the performance conditions for such awards as of the date of grant. Assuming the highest level of performance is achieved for the 2022 PSUs, the maximum value of such PSUs at the grant date would be as follows: Mr. Oviatt—$396,000; Mr. Tidball—$396,000; Mr. Fisher—$84,564; See Note 11 to Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2022 for a discussion of the relevant assumptions used in calculating the amounts reported for 2022.

4.Amounts in this column represent payments for performance under the executive annual incentive plans for 2022 and 2023 ("AIP"). The NEOs received their 2023 AIP awards in March of 2024 and their 2022 AIP awards in March 2023.

5.Mr. Fisher's salary is paid in CAD. The table above reflects the US Dollar equivalent of his salary on an annual average exchange rate of $0.7679 CAD to $1 USD for all 2022 compensation and an annual average exchange rate of $0.7409 CAD to $1 USD for all 2023 compensation.

Salary

Salary is used to recognize the experience, skills, knowledge and responsibilities required of all our employees, including our named executive officers. The salary for each named executive officer is typically set at the time the individual is hired based on the factors discussed in the preceding sentence and the negotiation process between the Company and the named executive officer. Thereafter, changes to annual salary, if any, are determined based on several factors, including evaluation of performance,

anticipated financial performance, economic circumstances, local market, labor conditions, and comparisons against market peer groups.

On July 2, 2020, the Board of Directors approved certain changes to the executive management team of the Company. Pursuant to these changes, Brenton W. Hatch transitioned from Chief Executive Officer and President of the Company to Executive Chairman through June 30, 2021. Ryan W. Oviatt was promoted to Co-Chief Executive Officer, Co-President, and Chief Financial Officer of the Company. Cameron M. Tidball was also promoted to Co-Chief Executive Officer and Co-President of the Company.

In connection with these appointments, on July 2, 2020, the Company entered into a Second Amended and Restated Employment Agreement with Ryan W. Oviatt (the Oviatt Agreement) and an Amended and Restated Employment Agreement with Cameron M. Tidball (the Tidball Agreement" and together with the Oviatt Agreement, the "Co-CEO Agreements")

Mr. Fisher entered into an employment agreement dated April 30, 2019 which set an annual base salary of $155,000 CAD.

The Co-CEO Agreements provide that each Mr. Oviatt and Mr. Tidball were entitled to receive a salary based on an annualized base salary of $275,000 USD for the period of July 2, 2020 through December 31, 2020.

Due to the impact of the COVID-19 pandemic on the Company, the executive management team elected to temporarily reduce wages for all employees (the “Furlough”). As part of the Furlough management elected not to participate in any incentive and bonus plans in fiscal year 2020. The Furlough reduced the salary owed to the NEOs by 8% effective in August 2020 throughout the remainder of fiscal year 2020. A Third Amended and Restated Employment Agreement reflecting this reduction with the NEOs was signed in April 2021. Pursuant to the Third Amended and Restated Employment agreements with each of Messrs. Fisher, Oviatt, and Tidball, their furloughed wages concluded on July 1, 2021. From the period of July 1, 2021 through December 31, 2021, Mr. Oviatt's annual salary rate was increased to $300,000 USD, and Mr. Tidball's annual salary rate was increased to $300,000 USD. Messrs. Tidball and Oviatt's annual salary rate was increased to $330,000 USD on January 1, 2022. On June 16, 2021 the Board approved raises to be effective July 1, 2021 for Mr. Fisher and pursuant to that action Mr. Fisher’s annual salary was increased to $170,000 CAD. In December 2021 the Board approved an additional raise for Mr. Fisher to increase his annual salary rate to $185,000 CAD to be effective January 1, 2022.

On March 6, 2023 the Board approved a raise for Messrs. Oviatt, Tidball and Fisher to be effective retroactively as of January 1, 2023. The annual salary rate for Mr. Oviatt was increased to $341,550 USD. The annual salary rate for Mr. Tidball was increased to $341,550 USD. The annual salary rate for Mr. Fisher was increased to $191,475 CAD.

On April 9, 2024 the Compensation Committee approved a raise for Messrs. Oviatt, Tidball and Fisher to be effective retroactively as of January 1, 2024. The annual salary rate for Mr. Oviatt was increased to $358,628 USD. The annual salary rate for Mr. Tidball was increased to $358,628 USD. The annual salary rate for Mr. Fisher was increased to $201,049CAD.

The annual salaries of Messrs. Oviatt, Tidball, and Fisher are otherwise subject to review by the Compensation Committee annually.

Bonuses

The Board may make cash awards to our NEOs that are not part of any pre-established, performance-based criteria. Awards of this type are completely discretionary and subjectively determined by our Board of Directors at the time they are awarded. In the event this type of cash award is made, it is reflected in the “Summary Compensation Table” under a separate column entitled “Bonus.”

On April 6, 2022, the Board approved the 2022 Executive Incentive Plan for Ryan W. Oviatt, the Company's Co-Chief Executive Officer, Co-President and Chief Financial Officer, Cameron M. Tidball, the Company's Co-Chief Executive Officer and Co-President, and Patrick Fisher, the Company's Vice President of Product Development for the Company’s 2022 fiscal performance. Under that plan, each participating executive officer was assigned a target bonus amount for fiscal 2022. The target bonus amount for Mr. Oviatt was $198,000, the target bonus amount for Mr. Tidball was $198,000, and the target bonus amount for Mr. Fisher was $64,750 CAD. The performance goals in the 2022 plan were based on the Company’s total revenue, EBITDA, and a non-financial milestone relating to revenue source diversification. Each of these performance goals was weighted one-third in calculating bonus amounts.

The bonus amounts earned under the 2022 Executive Incentive Plan were paid 50% in cash and 50% in shares of restricted stock under 2014 Equity Incentive Plan . In no event could the total award exceed 200% of the target bonus amount for each participant, or exceed any limitations otherwise set forth in the plan. The actual bonus amounts were determined by the Compensation Committee upon the completion of fiscal year 2022 and paid by March 15, 2023, subject to all applicable tax withholding. The bonuses paid under the plan were $349,866 to Mr. Oviatt, $349,866 to Mr. Tidball, and $114,413 CAD to Mr. Fisher.

On April 25, 2023, the Board approved the 2023 Executive Incentive Plan for Ryan W. Oviatt, the Company's Co-Chief Executive Officer, Co-President and Chief Financial Officer, Cameron M. Tidball, the Company's Co-Chief Executive Officer and Co-President, and Patrick Fisher, the Company's Vice President of Production Development for the Company’s 2023 fiscal performance. Under that plan, each participating executive officer was assigned a target bonus amount for fiscal 2023. The target bonus amount for Mr. Oviatt was $211,761, the target bonus amount for Mr. Tidball was $211,761, and the target bonus amount for Mr. Fisher was $70,846 CAD. The performance goals in the 2023 plan were based on the Company’s total revenue, EBITDA, and a non-financial milestone relating to revenue source diversification, and a non-financial metric based on safety and environment. Each of the Revenue, EBITDA, and Revenue Diversification metrics were weighted 30% and the Safety and Environment Metric was weighted 10% in calculating bonus amounts.

The bonus amounts earned under the 2023 Executive Incentive Plan were paid 50% in cash and 50% in shares of restricted stock under the 2023 Equity Incentive Plan. In no event could the total award exceed 200% of the target bonus amount for each participant, or exceed any limitations otherwise set forth in the plan. The actual bonus amounts were determined by the Compensation Committee upon the completion of fiscal year 2023 and paid by March 15, 2024, subject to all applicable tax withholding. The bonuses paid under the plan were $296,042 to Mr. Oviatt, $296,042 to Mr. Tidball, and $99,042 CAD to Mr. Fisher.

Equity Awards

Under the 2014 Equity Incentive Plan and the 2023 Equity Incentive Plan, the Compensation Committee, together with the Board, may elect to grant equity awards to the Company’s NEOs in the form of stock purchase options, restricted stock or restricted stock units. The Compensation Committee and the Board determine whether and how much to award based on numerous factors including, but not

limited to, Company performance, individual performance, competitive compensation practices, and incentive alignment. If the equity awards are granted, the Compensation Committee and the Board will determine the terms of the grant, including vesting, forfeiture, and dividend or voting rights, if any. In the event this type of equity award is made, it is reflected in the “Summary Compensation Table” under a separate column entitled “Stock Awards.”

The 2022 LTIP consists of total awards of up to 230,232 RSUs (“Units”) to Mr. Oviatt, up to 230,232 Units to Mr. Tidball, and up to 43,023 Units to Mr. Fisher, pursuant to two separate restricted stock unit award agreements (collectively, the "Restricted Stock Unit Award Agreements") entered between the Company and each participant. One such agreement covers 33% of each award recipient’s Units that are subject to time-based vesting, and the other such agreement covers the remaining 67% of such award recipient’s Units that may vest based on performance metrics. Upon vesting, the award agreements entitle the award recipients to receive one share of the Company’s common stock for each vested Unit. The vesting period of the 2022 LTIP began on January 1, 2022 and terminates on December 31, 2024 (the “Performance Vesting Date”).

The Units subject to time-based vesting, including 76,744 Units for Mr. Oviatt, 76,744 Units for Mr. Tidball, and 14,341 Units to Mr. Fisher, will vest in three equal and annual installments beginning December 31, 2022 and ending on December 31, 2024 if the award recipients’ employment continues with the Company through such dates.

The performance-vesting Units, including up to 153,488 Units for Mr. Oviatt, 153,488 Units for Mr. Tidball, and 28,682 Units to Mr. Fisher, may vest over a three-year performance period beginning January 1, 2022 (the “Performance Period”) based upon the following Company performance metrics:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Performance Metric | Weight | Target | Above Target | Outstanding |

| Total Shareholder Return (based on the Company’s closing price of its common stock at the end of the Performance Period relative to its closing price as of the last trading day in 2021) | 1/3 | 88.7% | 135.9% | 183% |

| Relative Total Shareholder Return (based on the Company’s ranked performance in closing stock price growth relative to a peer group of companies during the Performance Period) | 1/3 | Third Quartile | Second Quartile | First Quartile |

| EBITDA as a Percentage of Total Revenue | 1/3 | 10% | 15% | 20% |

One-third of such performance-vesting Units, consisting of 51,163 Units for Mr. Oviatt, 51,163 Units for Mr. Tidball, and 9,561 Units for Mr. Fisher, may vest for each of the three performance metrics identified in the table above. The number of Units that will vest for each performance metric on the Performance Vesting Date shall be determined as follows:

•if the “Target” level for such performance metric is not achieved, none of the Units relating to such performance metric will vest;

•if the “Target” level (but no higher level) for such performance metric is achieved, 50% of the Units relating to such performance metric will vest;

•if the “Above Target” level (but no higher level) for such performance metric is achieved, 75% of the Units relating to such performance metric will vest; and

•if the “Outstanding” level for such performance metric is achieved, 100% of the Units relating to such performance metric will vest.

The 2023 LTIP consists of total awards of up to 287,076 restricted stock units (“Units”) to Mr. Oviatt, up to 287,076 Units to Mr. Tidball, and up to 50,868 Units to Mr. Fisher, pursuant to two separate restricted stock unit award agreements (collectively, the "Restricted Stock Unity Award Agreements") to be entered between the Company and each participant. One such agreement covers 33% of each award recipient’s Units that are subject to time-based vesting, and the other such agreement will cover the remaining 67% of such award recipient’s Units that may vest based on performance metrics. Upon vesting, and subject to the Plan being approved by shareholders as described above, the award agreements entitle the award recipients to receive one share of the Company’s common stock for each vested Unit. The vesting period of the 2023 LTIP began on January 1, 2023, and terminates on December 31, 2025 (the “Performance Vesting Date”).

The Units subject to time-based vesting, including 95,692 Units for Mr. Oviatt, 95,692 Units for Mr. Tidball, and 16,956 Units to Mr. Fisher, will vest in three equal and annual installments beginning December 31, 2023 and ending on December 31, 2025 if the award recipients’ employment continues with the Company through such dates.

The performance-vesting Units, including up to 191,384 Units for Mr. Oviatt, 191,384 Units for Mr. Tidball, and 33,912 Units to Mr. Fisher, may vest over a three-year performance period beginning January 1, 2023 (the “Performance Period”) based upon the following Company performance metrics:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Performance Metric | Weight | Target | Above Target | Outstanding |

| Total Shareholder Return (based on the Company’s 10-day volume weighted average closing price of its common stock at the end of the Performance Period relative to its 10-day volume weighted average closing price as of the last trading day in 2022) | 1/3 | 94.2% | 142.7% | 191.3% |

| Relative Total Shareholder Return (based on the Company’s ranked performance in Total Shareholder Return as calculated above relative to a peer group of companies during the Performance Period) | 1/3 | Third Quartile | Second Quartile | First Quartile |

| EBITDA as a Percentage of Total Revenue | 1/3 | 15% | 17.5% | 20% |